SSC CGL - Detailed Guide 2025

Self-Paced Course

Economic Reforms in India

Reference: Lucent GK, NCERT Class 6–12

Liberalisation, Privatisation, Globalisation (LPG) – 1991 Reforms

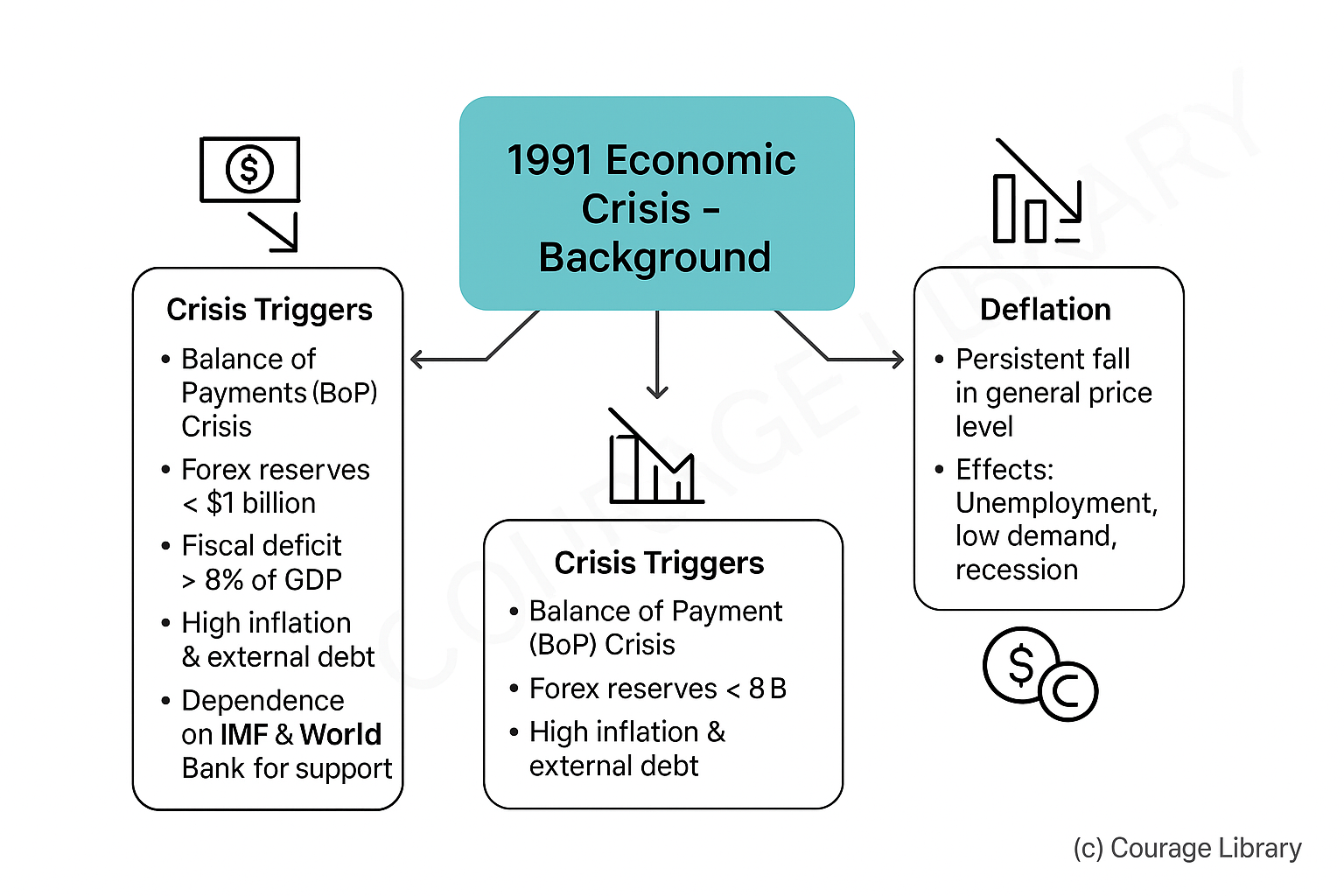

Background:

- Triggered by the 1991 Balance of Payments (BoP) Crisis:

- Forex reserves fell below $1 billion

- Fiscal deficit over 8% of GDP

- High inflation and external debt

- IMF & World Bank support conditional on structural reforms.

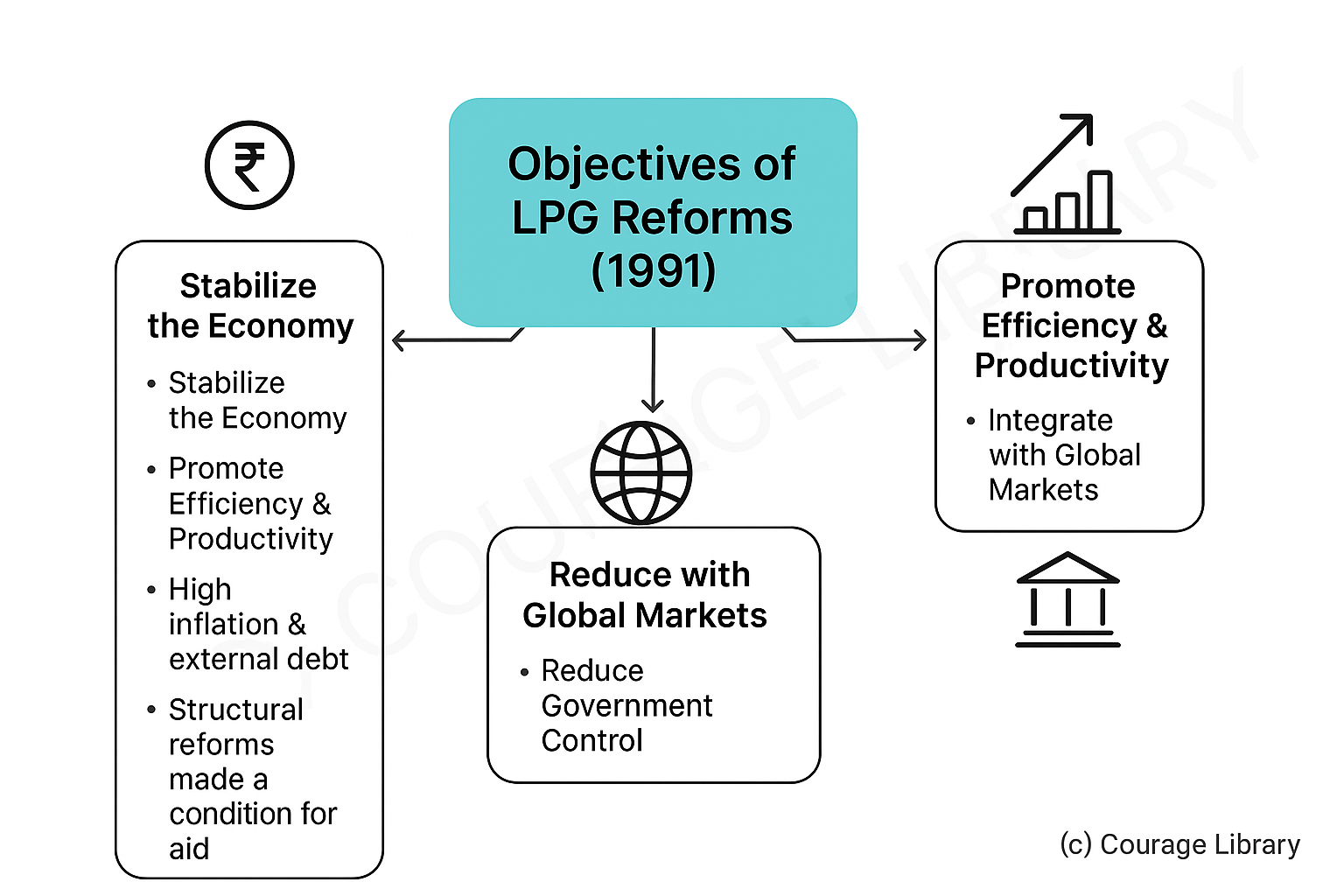

Objectives of LPG Reforms:

- Stabilize the economy

- Promote efficiency and productivity

- Integrate with global markets

- Reduce government control

Liberalisation

Freeing the economy from excessive government control.

| Key Areas Reformed | Description |

|---|---|

| Industrial Licensing (License Raj) | Abolished for most industries (except 18 strategic ones) |

| Foreign Investment | Automatic approval for FDI in many sectors |

| Foreign Exchange | Rupee devaluation; current account convertibility |

| Trade Policy | Import quotas removed; tariffs reduced |

| Financial Sector | Deregulation of interest rates; RBI autonomy improved |

Privatisation

Involving private sector in ownership and management of enterprises.

| Key Measures | Description |

|---|---|

| Disinvestment | Selling government stake in PSUs |

| Public-Private Partnership | Promoting joint ventures between govt and private players |

| Deregulation | Entry of private players in telecom, aviation, banking, etc. |

Globalisation

Integrating the Indian economy with the world.

| Key Aspects | Description |

|---|---|

| FDI & FII | Greater access to foreign capital |

| WTO Membership | Joined in 1995; commitment to fair trade practices |

| Exports/Imports | Liberalised trade policies; Special Economic Zones (SEZs) promoted |

| Outsourcing & IT Boom | India emerged as global IT/BPO hub |

Result: Faster GDP growth, better forex reserves, reduced poverty — but also increased inequality & dependence on global markets.

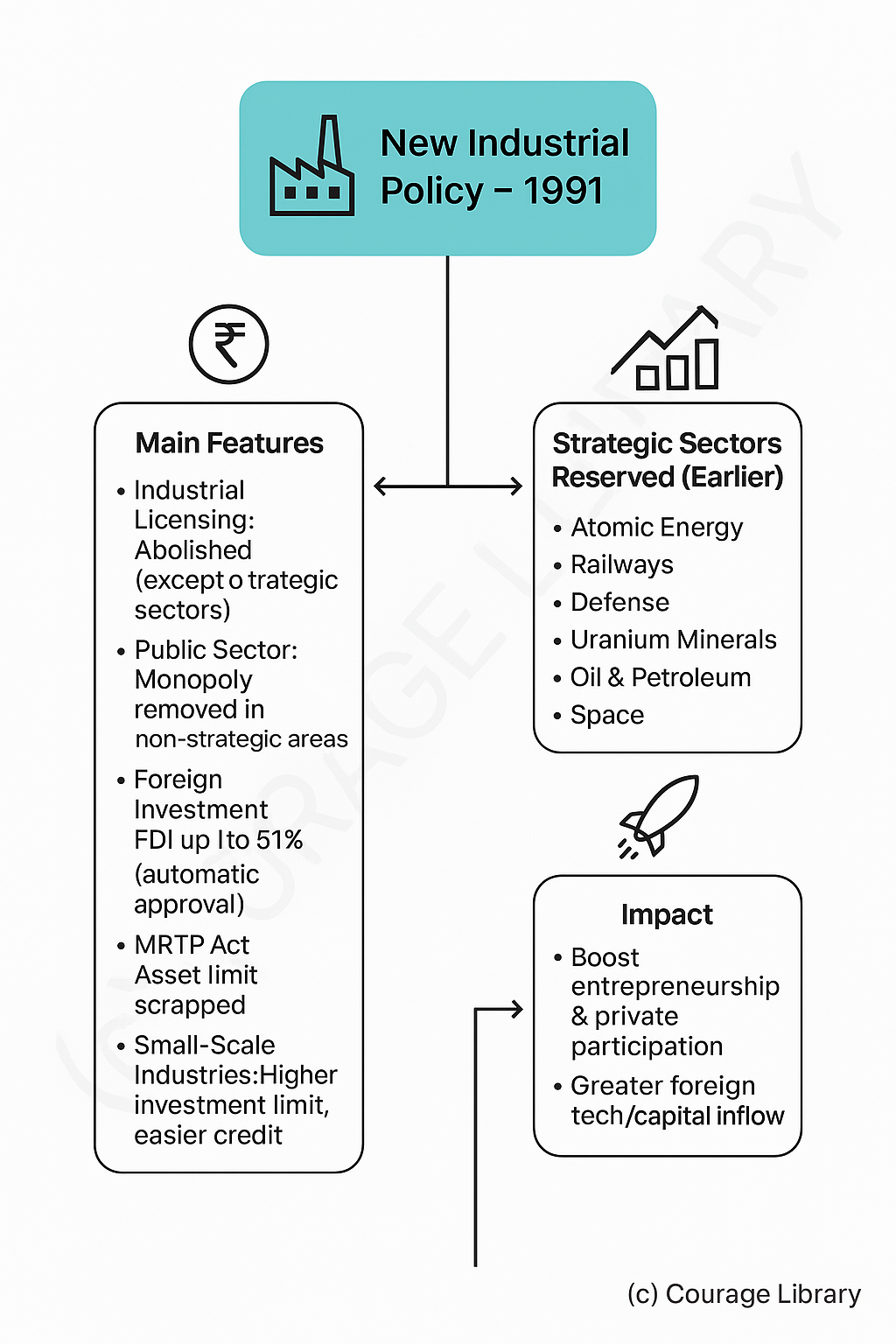

New Industrial Policy – 1991

Announced: July 24, 1991

Main Features:

| Area | Reform Measures |

|---|---|

| Industrial Licensing | Abolished for all industries except 6 strategic sectors (e.g. defense) |

| Public Sector | PSU monopoly removed in non-strategic areas |

| Foreign Investment | Automatic approval for FDI up to 51% in select sectors |

| MRTP Act | Threshold asset limit of firms removed |

| Small-Scale Industries | Investment limit enhanced; easier credit access |

Aim: Encourage competition, innovation, and private sector participation.

Strategic Sectors Reserved for Public Sector (now reduced further):

- Atomic Energy

- Railways

- Defense

- Minerals (like uranium)

- Oil and petroleum

- Space

Impact:

- Boost to entrepreneurship and investment

- Greater foreign tech and capital inflow

- Shift from commanding heights to facilitator government role

Disinvestment Policy

Definition:

- Selling government's equity (ownership) in Public Sector Undertakings (PSUs) to private investors.

Objectives:

| Objective | Description |

|---|---|

| Improve efficiency | Encourage professional/private management |

| Reduce fiscal burden | Mobilize resources for other public expenditure |

| Encourage competition | Break PSU monopoly, foster a level playing field |

Methods of Disinvestment:

| Method | Description |

|---|---|

| Minority Stake Sale | Govt retains majority control (>51%) |

| Strategic Sale | >51% stake sold along with management control |

| IPO/FPO | Shares offered to public through stock exchanges |

| ETF Route | Exchange-Traded Funds (e.g. Bharat 22 ETF) |

Key Agencies:

- Department of Investment and Public Asset Management (DIPAM)

- NITI Aayog gives strategic sale recommendations

Recent Trends (2020s):

- Major disinvestment cases: Air India (to Tata Group), BPCL, LIC IPO

- Strategic disinvestment target fixed annually in Budget

Developed By Jan Mohammad

Next

Start Your SSC CGL Journey Now!

Join Courage Library to experience disciplined study and expert support.

Be a Couragian!