SSC CGL - Detailed Guide 2025

Self-Paced Course

Government Budget and Fiscal Policy

Reference: Lucent GK, NCERT Class 6–12

1. Budget – Definition, Types

Definition:

A government budget is an annual financial statement showing estimated receipts and expenditures of the government for a particular financial year (April 1 – March 31), as per Article 112 of the Indian Constitution.

Types of Budget:

| Type | Description |

|---|---|

| Balanced Budget | Receipts = Expenditures |

| Surplus Budget | Receipts > Expenditures |

| Deficit Budget | Expenditures > Receipts (most common in India) |

| Zero-Based Budget | Every expense must be justified from zero; no carryover from previous year |

| Gender Budgeting | Allocation focused on improving women-centric outcomes |

| Outcome Budget | Links allocation with measurable outcomes |

| Interim Budget | Presented by outgoing govt for limited months before elections |

| Vote on Account | Temporary approval to withdraw funds until full budget is passed |

2. Components: Revenue vs Capital Budget

Revenue Budget:

| Revenue Receipts | Revenue Expenditure |

|---|---|

| Income with no obligation | Recurring govt spending |

| E.g., Tax & Non-Tax revenue | E.g., salaries, subsidies, interest payments |

| No asset creation | No asset creation |

Capital Budget:

| Capital Receipts | Capital Expenditure |

|---|---|

| Borrowings, disinvestment | Long-term asset creation, loans to states |

| Recovery of loans | Infrastructure, machinery, buildings |

| Liabilities created | Results in capital formation |

Summary Table:

| Aspect | Revenue Budget | Capital Budget |

|---|---|---|

| Nature | Recurring / Operational | Long-term / Asset-oriented |

| Examples | Tax revenue, interest income | Loans, disinvestment, borrowings |

| Impact | No asset creation | Leads to asset creation or liabilities |

3. Deficits: Fiscal, Revenue, Primary Deficit

Fiscal Deficit:

- Indicates total borrowing requirement of the govt

- Formula:

Total Expenditure – Total Receipts (excluding borrowings)

Revenue Deficit:

- Indicates shortfall in revenue account

- Formula:

Revenue Expenditure – Revenue Receipts

Primary Deficit:

- Fiscal deficit minus interest payments

- Formula:

Fiscal Deficit – Interest Payments

Quick Comparison:

| Deficit Type | Indicates |

|---|---|

| Fiscal Deficit | Total borrowing need |

| Revenue Deficit | Revenue account gap |

| Primary Deficit | Fiscal health excluding past debt |

4. Taxation: Direct vs Indirect Taxes

Direct Taxes:

| Description | Examples |

|---|---|

| Paid directly by individuals/entities | Income Tax, Corporate Tax |

| Cannot be shifted to others | Wealth Tax (abolished), Capital Gains Tax |

Indirect Taxes:

| Description | Examples |

|---|---|

| Collected via intermediaries | GST, Excise Duty, Customs Duty |

| Shiftable to end consumer | Paid indirectly at point of sale |

Key Differences:

| Feature | Direct Tax | Indirect Tax |

|---|---|---|

| Incidence | On taxpayer | On consumer |

| Burden transfer | Not possible | Can be shifted |

| Equity | Progressive | Regressive (affects poor more) |

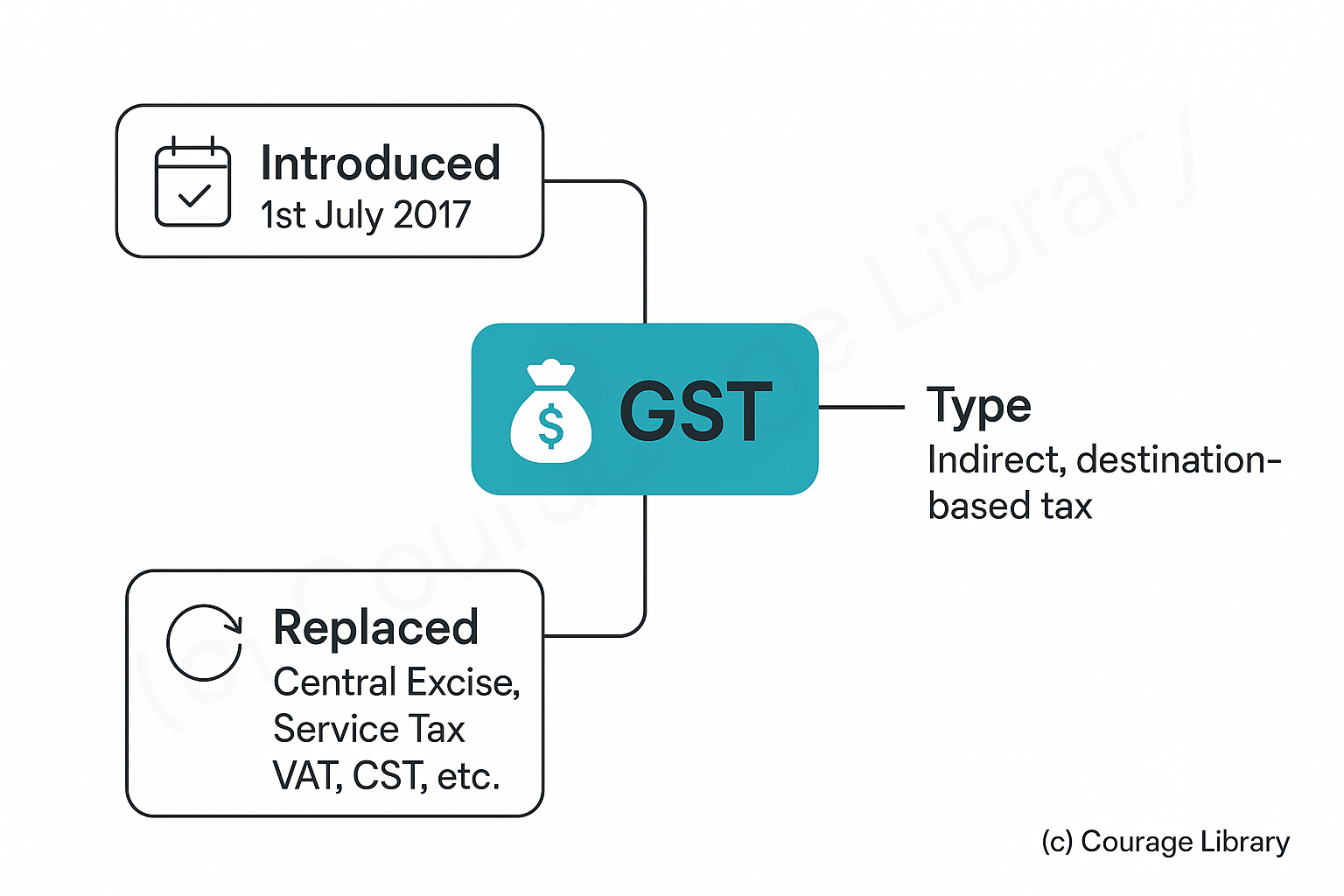

5. GST (Goods and Services Tax)

- Introduced: 1st July 2017

- Type: Indirect, destination-based tax

- Replaced: Central Excise, Service Tax, VAT, CST, etc.

Structure:

| Tax Component | Levied By |

|---|---|

| CGST | Central Govt |

| SGST | State Govt |

| IGST | Centre (for interstate sales) |

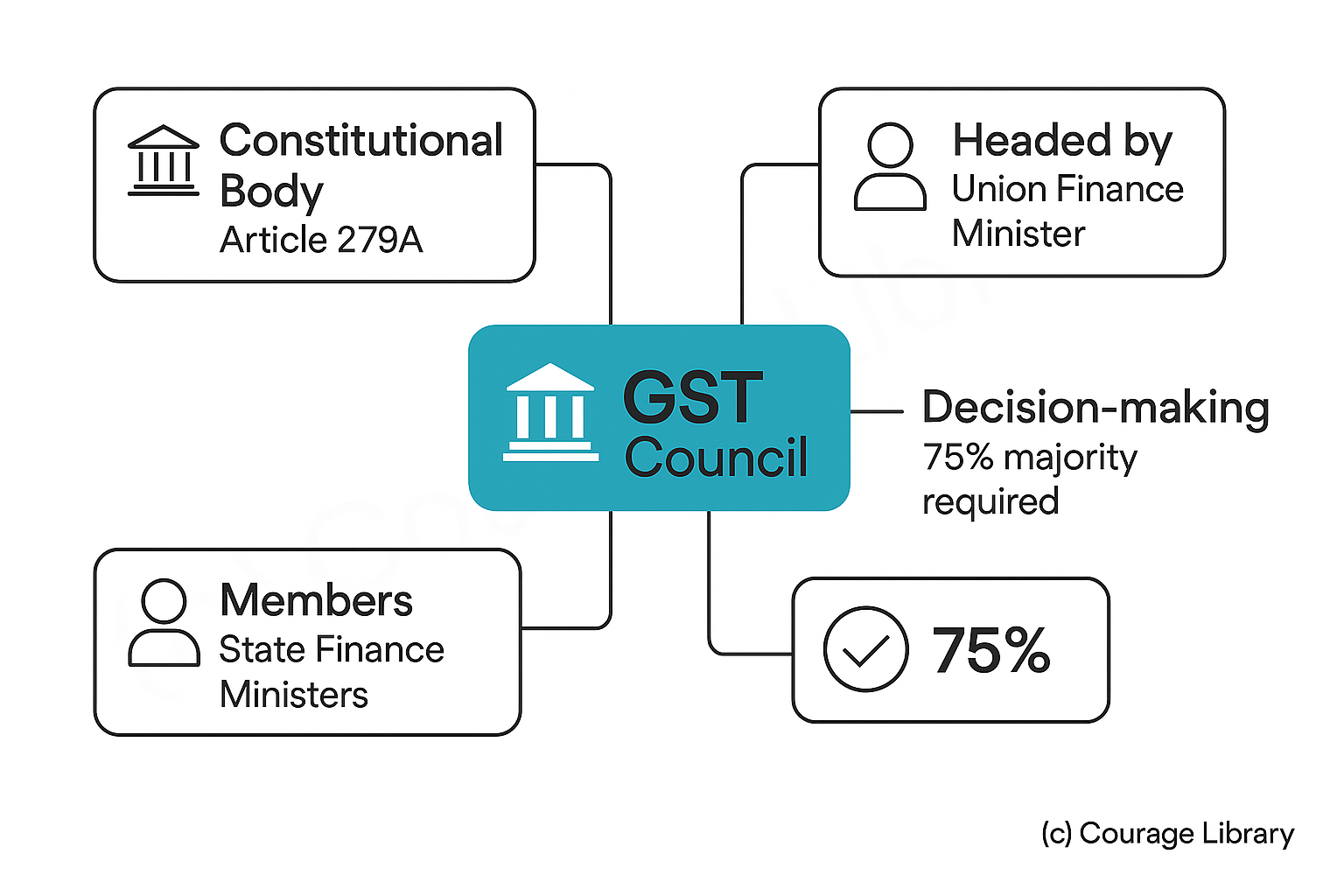

GST Council:

- Constitutional body under Article 279A

- Headed by Union Finance Minister

- Members: State Finance Ministers

- Decisions taken with 75% majority

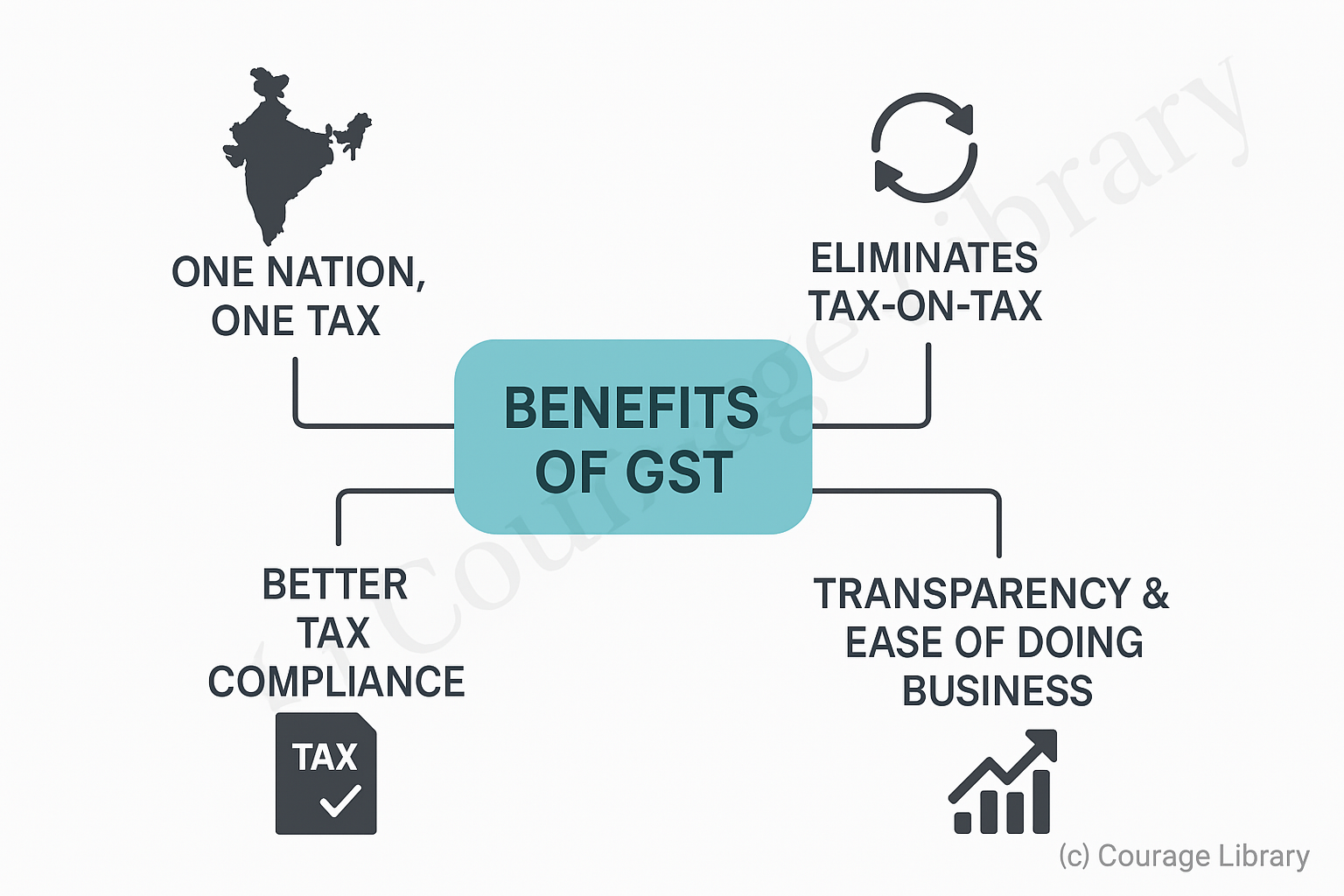

Benefits of GST:

- One nation, one tax

- Removes tax-on-tax

- Improves tax compliance

- Boosts transparency and ease of doing business

GST Slabs:

| Rate | Items Covered |

|---|---|

| 0% | Essential items (milk, fruits, vegetables) |

| 5% | Common items (edibles, footwear) |

| 12% | Processed foods, computers |

| 18% | Soaps, mobile phones |

| 28% | Luxury items (cars, tobacco, ACs) |

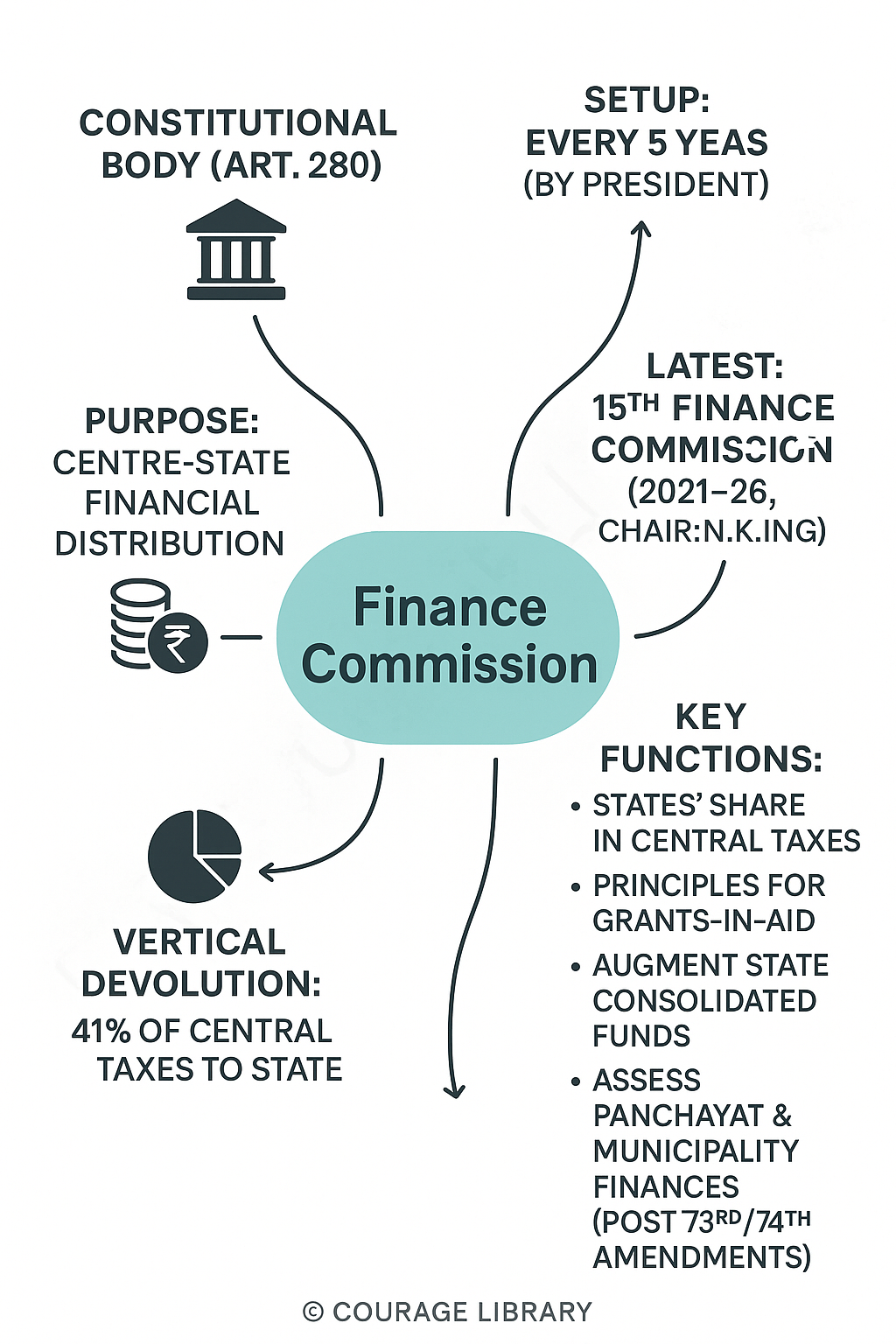

6. Finance Commission

- Constitutional Body: Under Article 280

- Setup: Every 5 years by the President of India

- Purpose: Recommend distribution of financial resources between Centre and States

Key Functions:

- Recommend share of states in central taxes

- Suggest principles for grants-in-aid

- Recommend ways to augment consolidated funds of states

- Assess finances of panchayats and municipalities (since 73rd/74th Amendments)

Latest: 15th Finance Commission (Chair: N.K. Singh)

- Period: 2021–26

- Vertical Devolution: 41% of central taxes to states

Developed By Jan Mohammad

Next

Start Your SSC CGL Journey Now!

Join Courage Library to experience disciplined study and expert support.

Be a Couragian!