SSC CGL - Detailed Guide 2025

Self-Paced Course

Foreign Trade and International Organisations

Reference: Lucent GK, NCERT Class 6–12

1. India's Foreign Trade – Imports/Exports Composition

Key Points:

- India follows a mixed economy model with liberalized trade policies post-1991.

- Trade is managed by the Ministry of Commerce and Industry.

- India's foreign trade accounts for ~40% of GDP (2023 estimate).

Export Composition (Major Items):

| Category | Products |

|---|---|

| Petroleum Products | Refined petrol, diesel |

| Engineering Goods | Machines, tools, auto components |

| Gems and Jewellery | Diamonds, gold jewellery |

| Textiles and Apparel | Cotton, readymade garments |

| Chemicals & Pharmaceuticals | Generic drugs, fertilizers |

| Agricultural Products | Basmati rice, tea, spices, marine items |

Import Composition (Major Items):

| Category | Products |

|---|---|

| Crude Oil & Petroleum | Largest import |

| Gold and Precious Stones | For consumption and re-export (jewellery) |

| Electronics | Mobiles, semiconductors |

| Machinery | Industrial equipment |

| Chemicals & Fertilizers | Raw materials for industries |

| Coal and Natural Gas | For power and industrial use |

Major Trade Partners:

Exports:

- USA

- UAE

- Netherlands

- Bangladesh

Imports:

- China

- USA

- UAE

- Saudi Arabia

2. Balance of Payments (BoP) and Trade Deficit

Balance of Payments (BoP):

- A statement that records all economic transactions between India and the rest of the world.

| BoP Account | Components |

|---|---|

| Current Account | Trade of goods/services, transfers, income |

| Capital Account | FDI, FII, ECBs, loans, NRI deposits |

Managed by RBI.

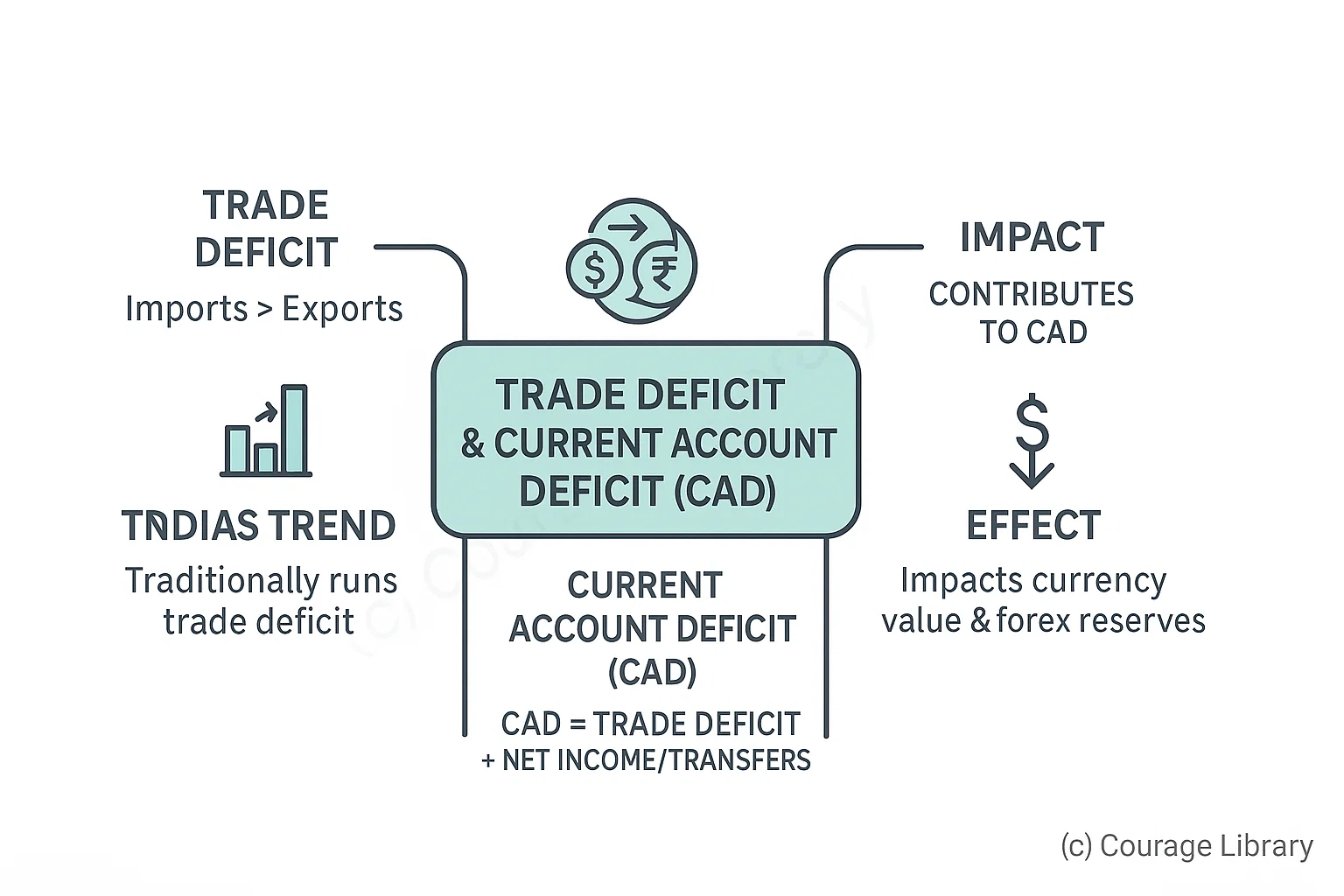

Trade Deficit:

- Occurs when imports > exports.

- India traditionally runs a trade deficit.

- Trade deficit contributes to current account deficit.

Current Account Deficit (CAD):

- CAD = Trade Deficit + Net income/transfers.

- High CAD can affect currency value and forex reserves.

3. Foreign Direct Investment (FDI)

Definition:

Investment made by a foreign entity into the capital/assets of Indian companies.

Types:

| Type | Example |

|---|---|

| Automatic Route | No prior govt. approval (most sectors) |

| Government Route | Requires prior approval (defense, media) |

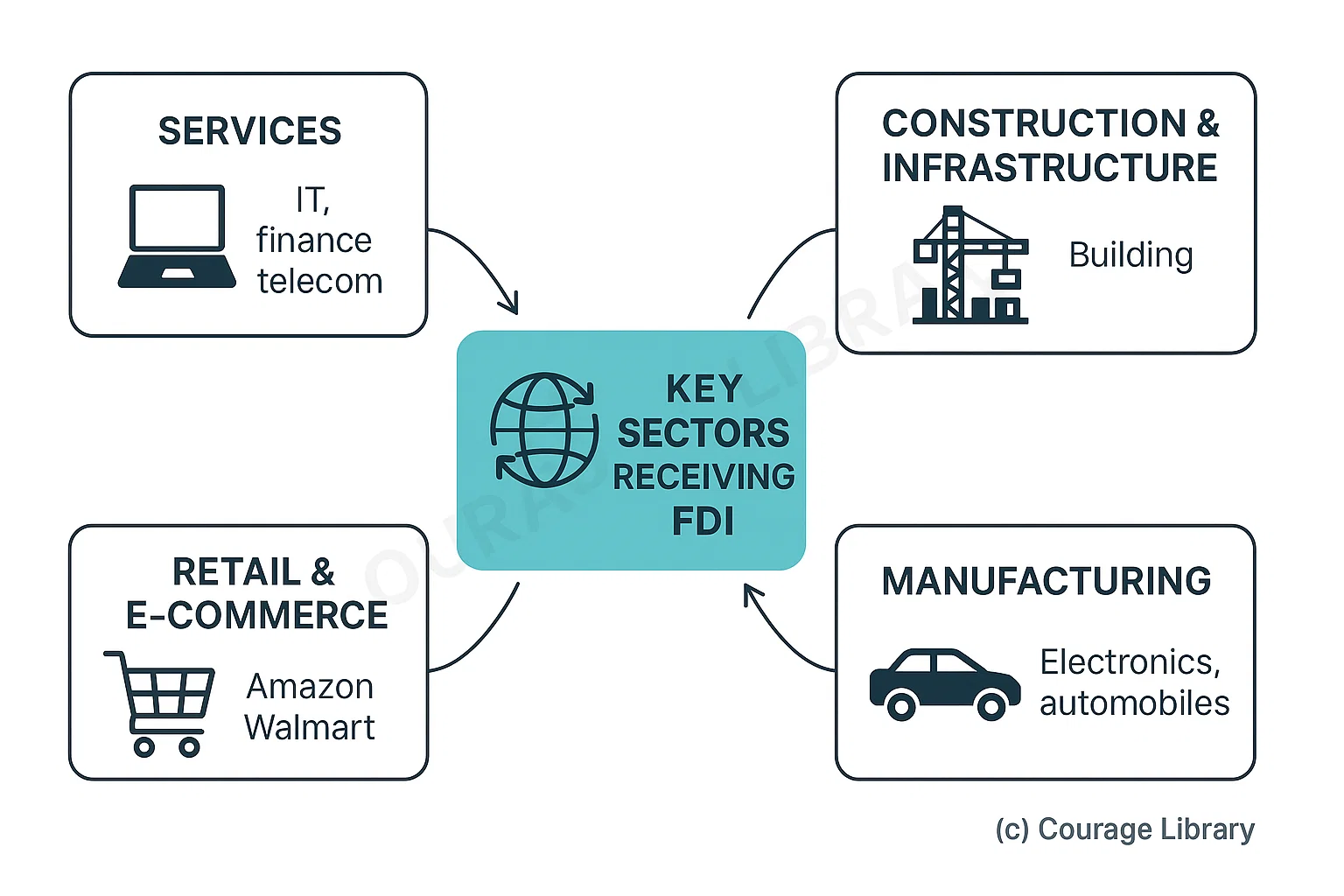

Key Sectors Receiving FDI:

- Services (IT, finance, telecom)

- Construction & infrastructure

- Retail and e-commerce (Amazon, Walmart)

- Manufacturing (especially electronics, automobiles)

FDI Benefits:

Capital inflow

Technology transfer

Employment generation

Boost to Make in India

FDI Regulator: Department for Promotion of Industry and Internal Trade (DPIIT)

4. WTO, IMF, World Bank, BRICS, ADB

WTO (World Trade Organization):

- Established: 1995

- HQ: Geneva, Switzerland

- Aim: Promote free and fair global trade

- Functions: Trade negotiations, dispute resolution, trade monitoring

- India's Interests: TRIPS (IPR), agricultural subsidies

IMF (International Monetary Fund):

- Established: 1944 (Bretton Woods)

- HQ: Washington, D.C.

- Aim: Ensure global monetary stability

- Key Roles:

- Lending to countries in crisis

- Surveillance and economic guidance

- Technical assistance

World Bank:

- Established: 1944

- HQ: Washington, D.C.

- Components: IBRD, IDA(part of World Bank Group)

- Focus: Long-term development aid

- Key Projects in India: Education, sanitation, water supply, rural roads

BRICS:

- Founded: 2009 (South Africa joined in 2010)

- Focus: Multilateral cooperation, reform of global institutions

- Institutions: New Development Bank (NDB)

- India's Role: Promoting multipolar global order

ADB (Asian Development Bank):

- Established: 1966

- HQ: Manila, Philippines

- Mandate: Socio-economic development of Asia-Pacific

- India: Major recipient of loans for infrastructure, health, urban reforms

5. Trade Agreements and Economic Diplomacy

Types of Trade Agreements:

| Type | Example |

|---|---|

| Bilateral Trade Agreement | India–UAE CEPA, India–Japan CEPA |

| Regional Trade Agreement | ASEAN–India FTA, SAFTA |

| Multilateral Trade Agreement | WTO agreements |

India's Major Trade Agreements:

- India–ASEAN Free Trade Agreement

- India–UAE CEPA (2022)

- India–Australia ECTA (2022)

- Ongoing negotiations: India–EU FTA, India–UK FTA

Economic Diplomacy:

- Using trade, investment, and aid to enhance foreign relations.

- Managed by Ministry of External Affairs (MEA) & Ministry of Commerce.

- Focus on:

- Energy security (e.g., Middle East, Russia)

- Supply chains diversification (e.g., Quad)

- Export promotion councils and overseas missions

Developed By Jan Mohammad

Next

Start Your SSC CGL Journey Now!

Join Courage Library to experience disciplined study and expert support.

Be a Couragian!