SSC CGL - Detailed Guide 2025

Self-Paced Course

Money and Banking

Reference: Lucent GK, NCERT Class 6–12

Functions of Money

Money = Any commodity that is universally accepted in exchange of goods and services.

Primary Functions:

| Function | Description |

|---|---|

| Medium of Exchange | Eliminates the need for barter system |

| Measure of Value | Common standard to measure value of goods |

Secondary Functions:

| Function | Description |

|---|---|

| Store of Value | Can be saved and used in future |

| Standard of Deferred Payment | Used for future payments, credit transactions |

Contingent Functions:

| Function | Description |

|---|---|

| Basis of Credit | Supports credit system via banks and lending |

| Liquidity Provision | Facilitates easy and quick transactions |

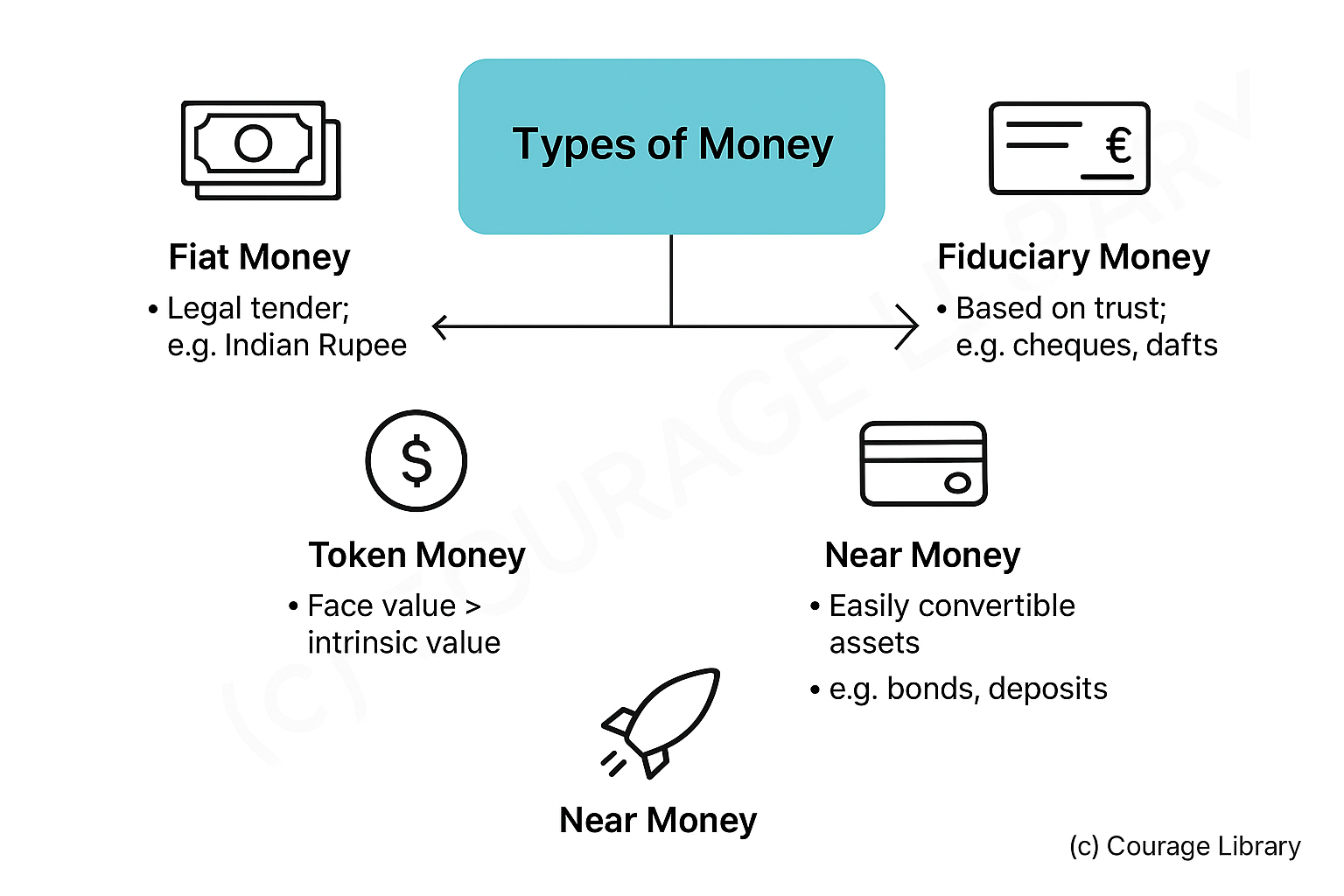

Types of Money:

- Fiat Money (legal tender): e.g. Indian Rupee

- Fiduciary Money: cheques, drafts

- Token Money: face value > intrinsic value

- Near Money: assets easily convertible to cash (bonds, deposits)

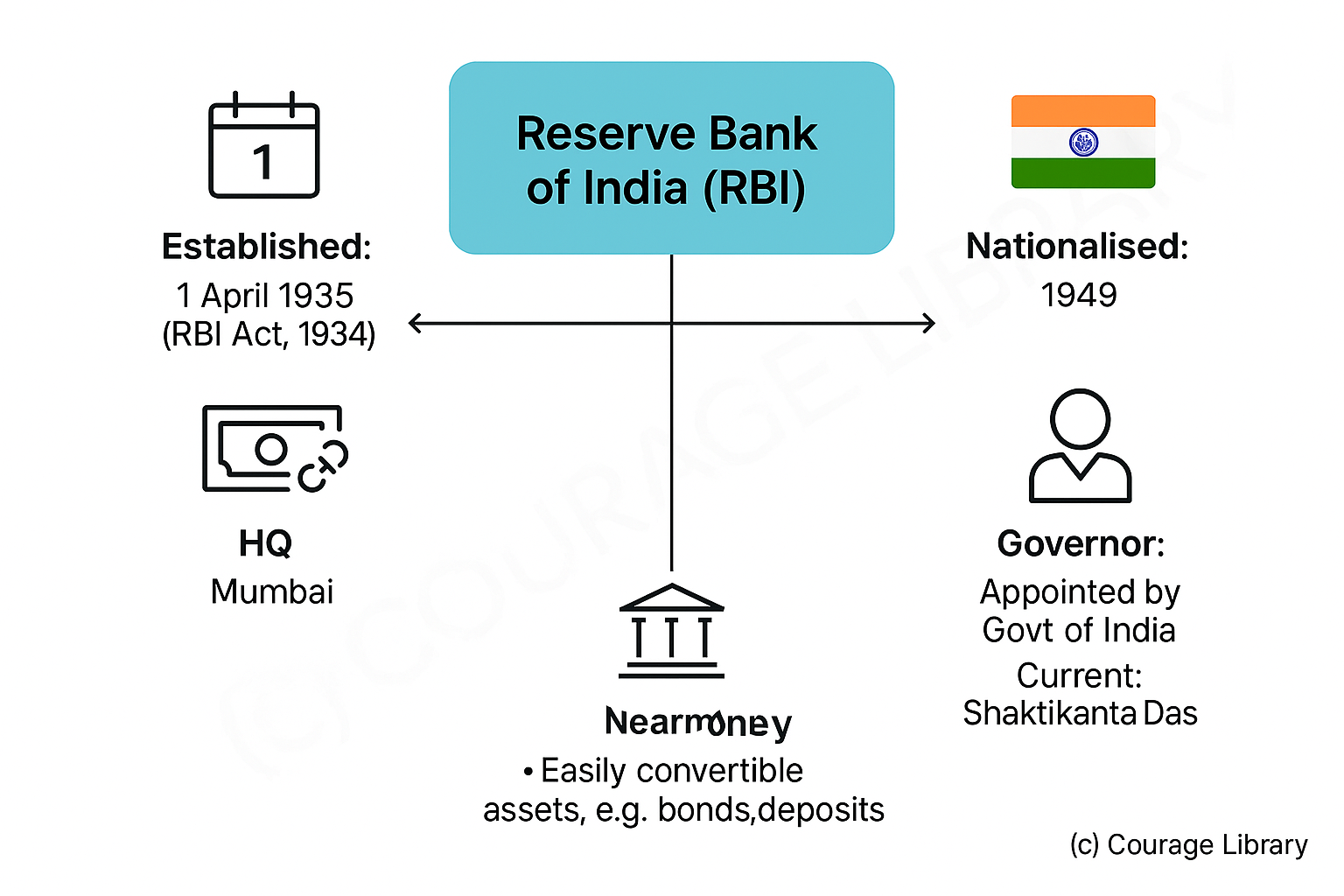

Reserve Bank of India (RBI)

- Established: 1 April 1935 under RBI Act, 1934

- Nationalised: 1949

- HQ: Mumbai

- Governor: Appointed by Government of India (Currently: Shaktikanta Das)

Key Functions of RBI:

| Function Category | Roles |

|---|---|

| Currency Issuer | Sole authority to issue currency in India (except ₹1 note/coin) |

| Banker to Government | Manages govt’s accounts, public debt & auctions |

| Banker’s Bank | Regulates and lends to commercial banks |

| Monetary Authority | Controls inflation, credit, and liquidity |

| Foreign Exchange Manager | Manages Forex reserves, exchange rate (via FEMA, 1999) |

| Supervisor & Regulator | Licenses banks, regulates NBFCs, ensures stability |

Monetary Policy Tools (to control inflation & liquidity):

| Tool | Description |

|---|---|

| CRR (Cash Reserve Ratio) | % of net demand & time liabilities (NDTL) banks must keep with RBI in cash |

| SLR (Statutory Liquidity Ratio) | % of NDTL banks must maintain in gold/govt securities |

| Repo Rate | Rate at which RBI lends to banks → ↑ Repo = ↓ money supply |

| Reverse Repo Rate | Rate at which RBI borrows from banks → tool to absorb excess liquidity |

| Bank Rate | Long-term lending rate by RBI (not for daily operations) |

| MSF (Marginal Standing Facility) | Emergency borrowing by banks from RBI at slightly higher rate |

| Open Market Operations (OMO) | Buying/selling govt securities to control liquidity |

RBI's monetary policy is announced bi-monthly by the Monetary Policy Committee (MPC).

Monetary Policy vs Fiscal Policy

| Aspect | Monetary Policy (by RBI) | Fiscal Policy (by Govern- ment) |

|---|---|---|

| Authority | RBI (Monetary Policy Committee) | Ministry of Finance |

| Focus | Control inflation, interest rates | Revenue generation & expenditure |

| Instruments | Repo, CRR, SLR, etc. | Taxes, public spending, subsidies |

| Type | Indirect tool | Direct tool |

| Speed of Implement- ation | Faster | Comparatively slower |

Commercial Banks – Functions, Types

Functions of Commercial Banks:

| Function Type | Description |

|---|---|

| Primary Functions | Accept deposits (savings, current, fixed), lend money |

| Secondary Functions | Issue drafts, locker facility, bill payments, forex services |

| Credit Creation | Lend more than deposits through fractional reserve system |

Types of Banks:

| Type | Examples |

|---|---|

| Public Sector Banks | SBI, Bank of Baroda, PNB |

| Private Sector Banks | HDFC, ICICI, Axis |

| Foreign Banks | HSBC, Citibank, Standard Chartered |

| Regional Rural Banks | Prathama Gramin Bank |

| Cooperative Banks | District & Urban cooperative banks |

| Small Finance Banks | AU SFB, Equitas SFB |

| Payments Banks | Airtel Payments Bank, India Post Payments Bank |

Scheduled vs Non-Scheduled Banks: Scheduled banks are listed in the Second Schedule of RBI Act, 1934 and maintain CRR with RBI.

Digital Payments and UPI

UPI (Unified Payments Interface):

| Feature | Description |

|---|---|

| Launched by | NPCI (National Payments Corporation of India) in 2016 |

| Real-time | Instant transfer 24x7 across banks |

| Linked to Mobile | Uses mobile number + UPI ID (e.g., name@upi) |

| Interoperability | Works across apps like PhonePe, GPay, BHIM, Paytm etc. |

Other Digital Payment Methods:

| Method | Description |

|---|---|

| NEFT | Batch-based fund transfer (no min limit) |

| RTGS | Real-time transfer for high-value (≥ ₹2 lakh) |

| IMPS | Instant transfer; 24x7 service |

| AEPS | Aadhaar Enabled Payment System |

| QR Code Payments | Scan-and-pay via UPI/Wallets |

| Mobile Wallets | Paytm, Freecharge, Mobikwik |

| Debit/Credit Cards | Card-based offline & online payments |

Key Initiatives:

- Digital India Campaign

- Jan Dhan – Aadhaar – Mobile (JAM Trinity)

- UPI Lite for small payments

- Bharat Bill Payment System (BBPS)

Developed By Jan Mohammad

Next

Start Your SSC CGL Journey Now!

Join Courage Library to experience disciplined study and expert support.

Be a Couragian!