SSC CGL - Detailed Guide 2025

Self-Paced Course

Centre–State Relations

Reference: Lucent GK, NCERT Class 6–12

1. Legislative, Administrative & Financial Relations

Constitutional Basis: Part XI (Articles 245–263)

A. Legislative Relations — Articles 245–255

| Subject | Description |

|---|---|

| Distribution of Powers | Via Seventh Schedule – 3 Lists:

|

| Residuary Powers | Parliament has exclusive power (Art. 248) |

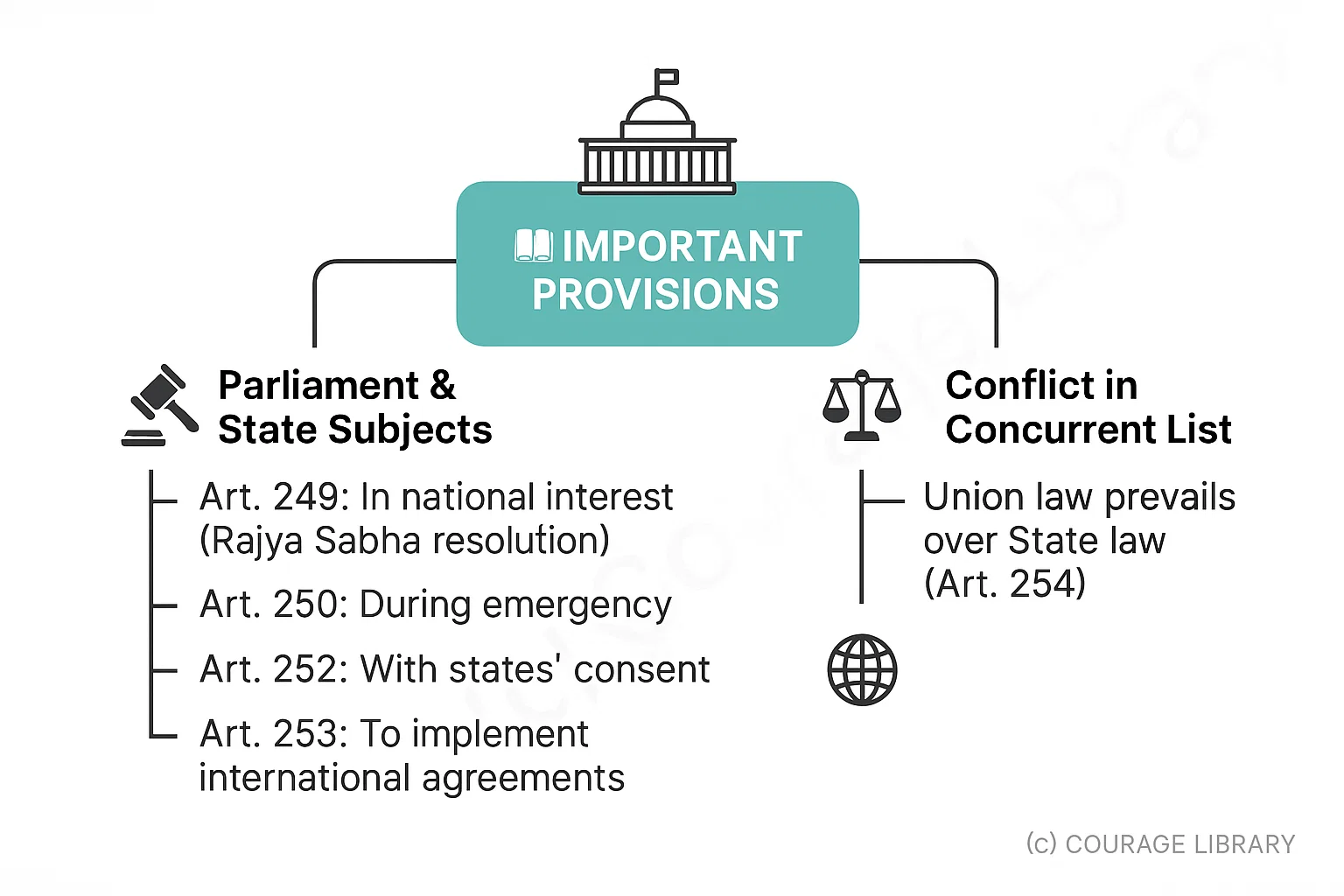

Important Provisions:

- Parliament can legislate on State subjects:

- In national interest (Art. 249 – Rajya Sabha resolution)

- During emergency (Art. 250)

- With states' consent (Art. 252)

- To implement international agreements (Art. 253)

- Conflict in Concurrent List: Union law prevails over State law (Art. 254)

B. Administrative Relations — Articles 256–263

| Aspect | Description |

|---|---|

| Executive Power | States to comply with Union laws and not impede Union executive power |

| Centre's Directions | Can direct states for construction of communication, Hindi promotion, etc. |

| Delegation of Union Functions | President may entrust functions to states with consent (Art. 258) |

| Obligation of State & Union | Mutual cooperation required |

| All-India Services | IAS, IPS, IFoS – Common to Centre and States |

| Inter-State Council | Established under Article 263 for coordination (explained below) |

C. Financial Relations — Articles 268–293

| Feature | Description |

|---|---|

| Taxation Powers | Clearly divided between Centre and States |

| Centre levies & collects | Customs, excise (except alcohol), income tax (except on agriculture), etc. |

| States levy & collect | Sales tax, land revenue, stamp duty, etc. |

| Shared Revenue | Article 270 – Income tax & Union excise shared between Centre & States |

| Grants-in-aid | Article 275 – Grants from Union to certain states |

| Finance Commission | Article 280 – Recommends distribution of taxes between Centre & States |

| Loans to States | Article 293 – Centre may lend and regulate borrowing by States |

GST: Introduced via 101st Amendment Act, 2016 – Combined indirect taxes of Centre & States

2. Inter-State Council

Article 263 – Recommended by Sarkaria Commission

Purpose: To discuss, investigate, and advise on inter-state matters

| Feature | Details |

|---|---|

| Established | 1990 by Presidential Order |

| Chaired by | Prime Minister of India |

| Members | Chief Ministers of all States & UTs with legislature |

| Role | Forum for dialogue between Centre and States |

| Functions | Coordination, resolving disputes, policy formulation |

Not a permanent constitutional body; can be dissolved/reconstituted by President

3. Zonal Councils

Statutory Bodies under States Reorganisation Act, 1956

Purpose: Promote cooperation among states in each zone

| Zone | Includes States/UTs |

|---|---|

| Northern | Delhi, Haryana, Himachal Pradesh, J&K, Punjab, Rajasthan, Chandigarh |

| Central | Chhattisgarh, Madhya Pradesh, Uttarakhand, Uttar Pradesh |

| Eastern | Bihar, Jharkhand, Odisha, West Bengal |

| Western | Goa, Gujarat, Maharashtra, Dadra & Nagar Haveli, Daman & Diu |

| Southern | Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, Telangana, Puducherry |

North-Eastern: NOT under Zonal Councils → covered under separate North Eastern Council (NEC)

Key Points:

- Chaired by Union Home Minister (Standing Committee led by Home Secretary)

- Chief Ministers of states in the zone = Vice Chairperson (rotation basis)

- Discuss inter-state cooperation in transport, border disputes, language, economy, etc.

Summary Table:

| Relation Type | Articles | Key Body/ Mechanism |

|---|---|---|

| Legislative | 245–255 | 3 Lists in Seventh Schedule |

| Administrative | 256–263 | Inter-State Council, Directions by Centre |

| Financial | 268–293 | Finance Commission, Grants, Shared Taxes |

Start Your SSC CGL Journey Now!

Join Courage Library to experience disciplined study and expert support.

Be a Couragian!